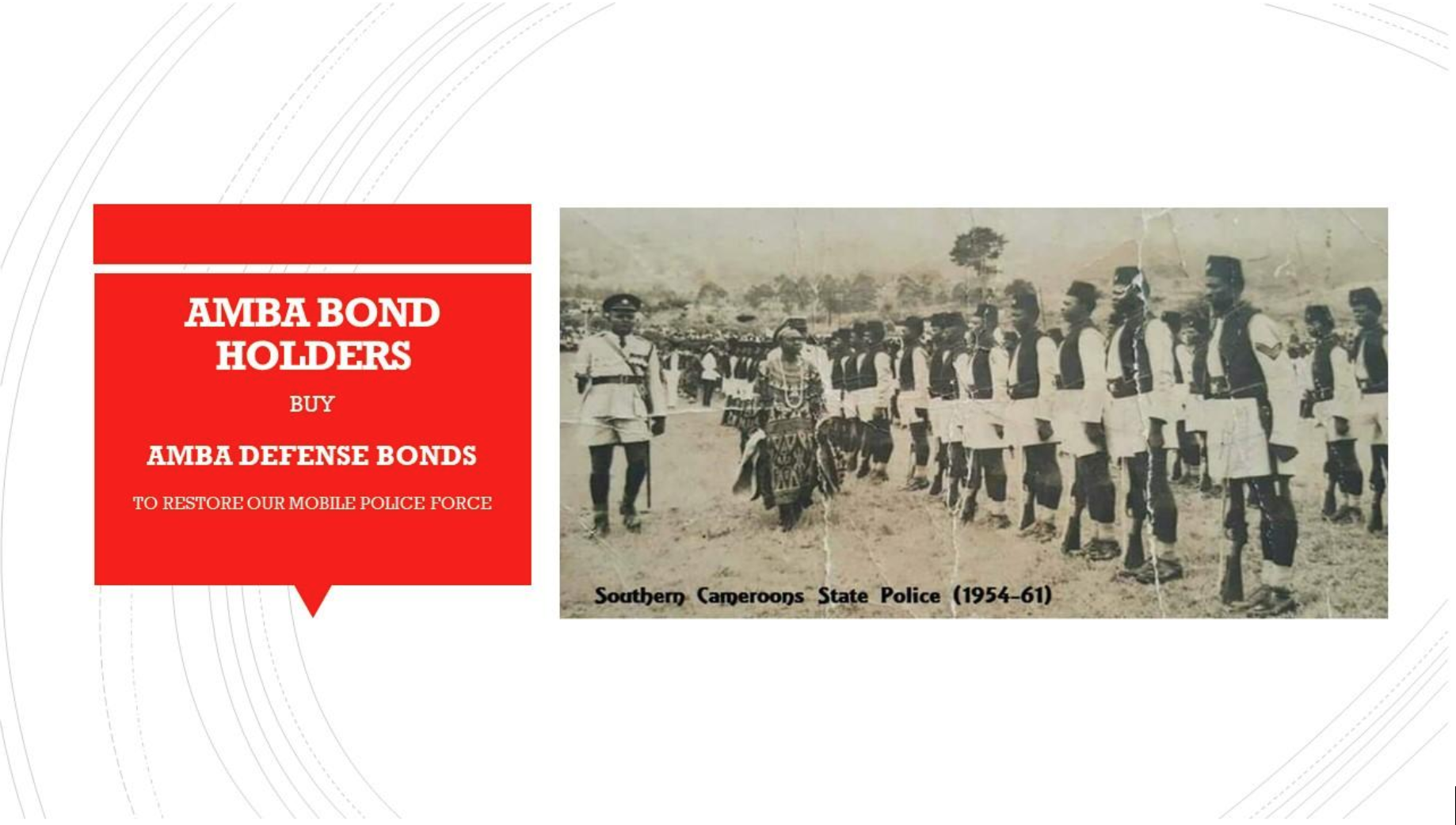

Amba Bond Holders

Ambabondholders.com is the first and only financial services website that lets you buy and redeem securities directly from the Interim Government in paperless electronic form. The website allows you to enjoy the flexibility of managing your investment savings portfolio online as your needs and financial circumstances change - all the time knowing your money is backed by the full faith and resources of the people of Southern Cameroons.

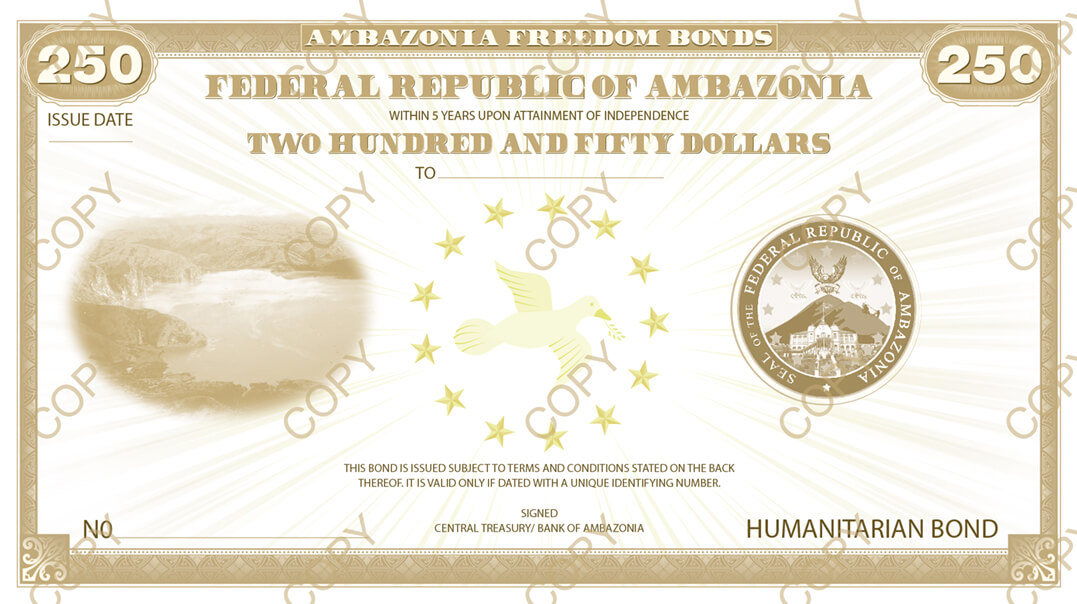

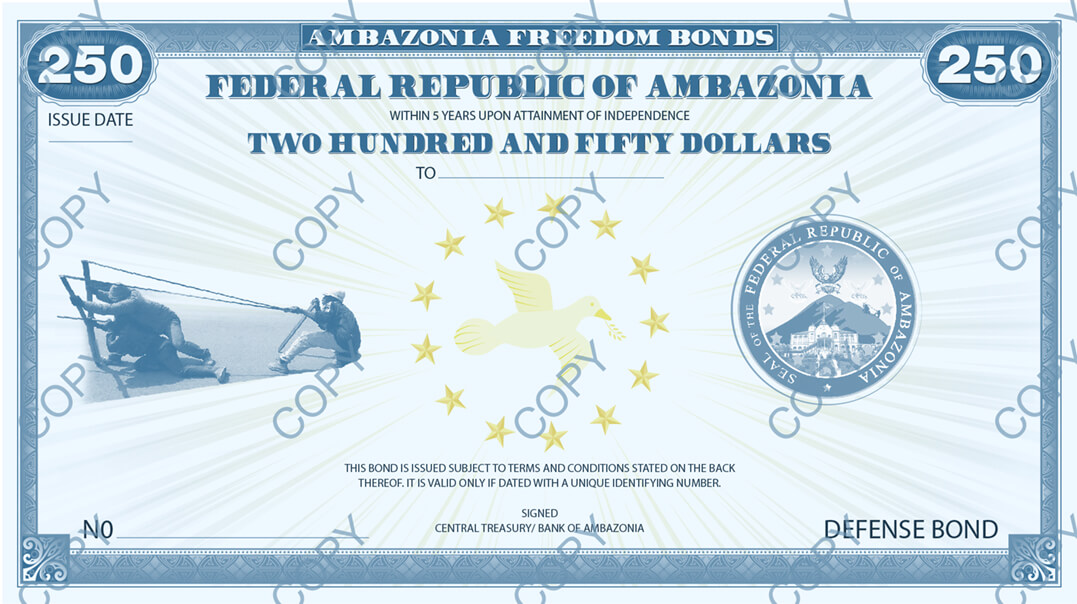

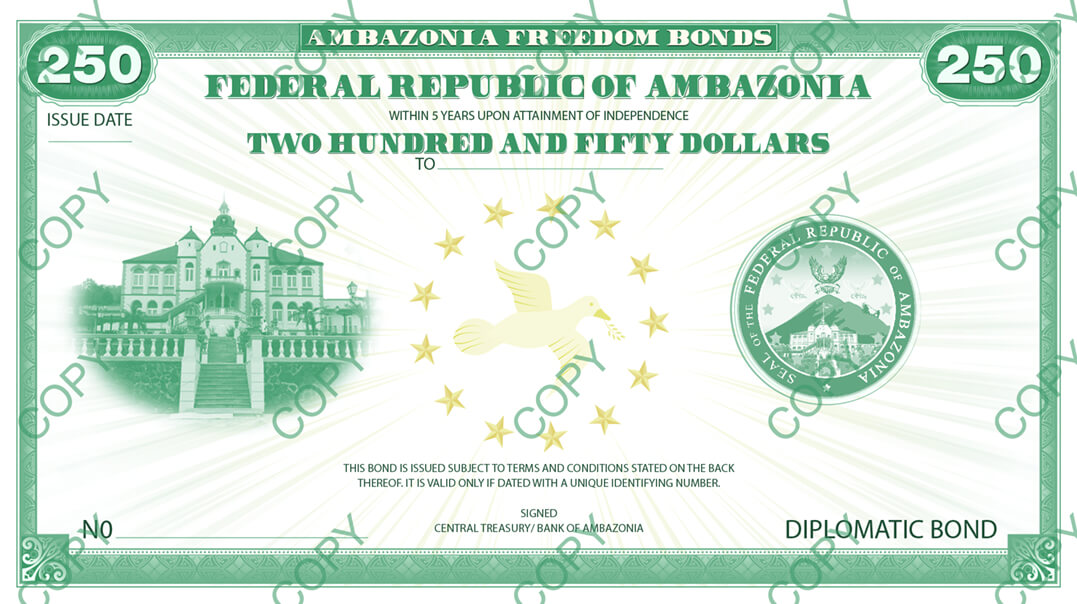

We offer product information and research across the entire line of Treasury securities, from Defense Bonds, Diplomatic Bonds, Humanitarian Bond in electronic form in one convenient account.

Ambabondholders.com is brought to you by the Department of the Economy and Finance and Bank of Ambazonia. The mission of the Bank of Ambazonia is to raise the money needed to prosecute the revolution and to account for the resulting debt. We do this by offering you a variety of savings and investment products.

Treasury Bonds

Amba Treasury bonds will pay a fixed rate of interest at maturity. They are issued in a term of 10-30 years.

You can buy Amba Treasury bonds from us in Ambabondholders.org. You also can buy them through a meeting, Njangi and church houses. Bonds must be held until maturity. When the bond matures, Bondholders will be paid interest and the face value.

Key Facts/Marketing Strategy

-

The yield on the bond is determined at initial offering.

-

Bonds are sold in increments of $250. The minimum purchase is $250.

-

You must hold the bond until its maturity

-

Initial offering will be up to $10 million in bonds.

-

Willing Ambazonians, individuals or community groups, can buy bonds in 250 units (minimum) through country/regional coordinators, meeting houses, county representatives, ground zero agents or online from https://ambabondholders.com. There is no upper limit unless over-subscribed.

-

It is the patriotic duty of every freedom-seeking Ambazonian at home and in the diaspora to market the Freedom Bond.

-

Upon confirming payment, bond certificates issued by the Bank of Ambazonia shall be securely printed and mailed to investors. For reasons of security and confidentiality, bond certificates responding to investments from Ambazonia shall be optionally deposited with relatives and friends abroad or otherwise kept at the treasury.

-

Fee-based commission agents are encouraged to sell the bonds on behalf of the Interim government in return for a fee-based commission or percentage (10%?)

-

The Freedom Bond shall be transferable to spouses and off-springs free of any taxes.

Use Amba bonds to:

-

Diversify your investment portfolio

-

Beginning investing in the future of Ambazonia

-

Supplement retirement income

-

Finance the future of your children/grandchildren education

|

Original Issue Rate |

The yield determined at issuance |

|

Minimum Purchase: |

$250 |

|

Maximum Purchase at issuance |

$10 million |

|

Investment Increments |

Multiple of $250 |

|

Issue Method: |

Electronic and Paper |

Rates & Terms

-

Bonds pay interest only when they mature. When a bond matures, the owner is paid the face value of the bond and earned interest.

-

Bonds must be held until maturity

Redemption Information

-

Minimum Term of Ownership: In Amba Bonds, 10 years

-

Interest Earning Period: To maturity

Defense Bonds

Defense Savings Bonds:

The Diplomatic Bond:

To help Ambazonians finance their dream of Restoration of Independence of Southern Cameroons through diplomacy, the Interim Government is introducing the Diplomatic bond. Under this program, Ambazonians who believe in a diplomatic solution to the fight for the Restoration of Independence could safely fund the diplomatic push with their investment.

The Humanitarian Bond